Financial management is crucial to establishing stability and growth. However, 20% of businesses fail during the first year, 30% in the second year, and 50% in the fifth year. Proper budgeting is key to achieving business success!

Source: Forbes

But how can you effectively budget your business finances? One popular approach is using Google Sheets budget templates, which offer a straightforward method for tracking income and expenses. It provides a foundation for efficient and effective budgeting. Many spreadsheet solutions allow you to customize templates based on your specific business requirements, utilize built-in formulas for calculations, and generate visual representations of your data for valuable insights. By leveraging digital budgeting tools, you can streamline your budgeting process and gain a clearer picture of your financial status. This article will help you choose, customize, and optimize a Google Sheets budget template. Read on to learn how to use one of these templates to handle your business finances.

What Are Google Sheets Budget Templates?

Google Sheets budget templates are exactly what they are—templates used for budgeting your finances, whether for business or personal purposes.

These templates let you manage your cash flow more swiftly and seamlessly by tracking your income and expenses. With budget details in place, you can have a clear picture of your financial status and, more importantly, make informed financial decisions.

Wondering what they look like? Here’s a pretty straightforward example of a Google Sheets budget template:

As you can see, Google Sheets budget templates can be broad or detailed. They allow you to highlight your income and sort your expenditures into various categories. They usually include the following details:

☑ Variable or fixed costs

☑ Cash flow

☑ Income

☑ Expenses

☑ Profit

☑ Financial losses

What’s great about these templates is that they ensure comprehensive data recording and financial management for your business finances. Not only do they let you track all your financial transactions, but they also enable you to customize the templates themselves according to your business needs and requirements.

Find out how Google Sheets budget templates benefit your company or organization below.

Key benefits of using Google Sheet Budget Templates

Forresters reported budgeting trends in 2024 across different functions and various industries. Here are some interesting statistics for the year:

☑ Technology: Nearly 85% of tech leaders expect an increase in budget.

☑ Marketing: About 80% of marketing leaders anticipate some level of budget.

☑ Sales: Three-quarters of sales leaders expect a boost in spending.

☑ Customer experience (CX): Almost 65% of business leaders plan to increase their budgets for CX initiatives.

For further details, take a look at the facts and figures below:

Source: Forrester

Proper budgeting, however, is essential for your company or organization. Unfortunately, there are a lot of financial details to record, track, and organize. Whether for technology, sales, marketing, human resources (HR), or core operations, stay on top of your business finances.

The use of spreadsheets is key. That said, here’s how Google Sheets budget templates can help:

☑ Unified budgeting sheet: They allow you to track all your spending, costs, and budget, all in one place. Thus, they eliminate the need to switch from one platform to another.

☑ Budget customization options: You can modify your templates to meet your budget needs. They let you tailor them to your company’s unique financial situation.

☑ Efficient financial tracking: They let you access and update your budget from anywhere at any time. Doing so ensures you have accurate, complete, and up-to-date financial records.

☑ Guaranteed data accuracy: With these templates in place, you can rely on built-in formulas to avoid costly budgeting errors. That enhances the accuracy and reliability of your financial information.

☑ Effective financial management: They help you gain financial insights and make informed decisions. How? Your robust oversight aids in identifying financial trends, forecasting future spending, and optimizing resource allocation.

In the next section, learn how to leverage Google Sheets budget templates to boost your company’s finances.

How To Manage Your Business Finances with Google Sheet Budget Templates

Google Sheet budget templates are best for efficiently and effectively managing your company’s finances. These templates offer a structured approach to organizing income, expenses, and financial data, simplifying the budgeting process.

Some companies and organizations go as far as investing in spreadsheet software used for financial, task, and project management. In fact, its global market size is forecasted to grow from $10.79 billion in 2024 to $14.55 billion by 2028 at a compound annual growth rate (CAGR) of 7.8%.

Source: thebusinessresearchcompany

However, the use of spreadsheets remains classic—a viable solution for proper budgeting. Still, you have to make the most of these templates to boost your business’s finances. Here’s how:

1. Set your Budget Goals

Start by defining your financial objectives clearly and realistically. This step entails outlining your specific targets for revenues, expenditures, savings, and even investments. Establishing SMART goals and OKR objectives will provide a roadmap for your budgeting efforts and guide your financial decisions.

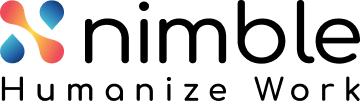

In creating and tracking OKR goals, Nimble’s OKR feature can help businesses streamline their goal-setting and performance management processes. By integrating OKRs into the business workflow, Nimble allows teams to set, track, and measure key results alongside project tasks. This seamless integration enables businesses to align their strategic objectives with day-to-day operations, providing a clear line of sight from high-level goals to actionable tasks. Nimble’s user-friendly interface makes it easy for teams to collaborate on OKRs, update progress in real-time, and visualize goal attainment through intuitive dashboards. This comprehensive approach to OKR management helps businesses maintain focus on their most important objectives, foster accountability, and drive measurable results across the organization.

Here are common budget goals your business might have:

☑ To boost revenue: Are you looking to increase your sales or find new revenue streams to grow your finances?

☑ To reduce expenses: Are you planning to cut unnecessary expenditures by finding more cost-effective alternatives?

☑ To build an emergency fund: Do you plan to set aside funds for unexpected expenses or economic downturns for financial stability?

☑ To pay off debt: Are you working towards reducing or eliminating outstanding debts to improve your cash flow and financial health?

☑ To save for investments: Do you seek to accumulate funds for future investments like new equipment, expansion, or innovation initiatives for business growth?

Jerry Han, CMO at PrizeRebel, suggests defining financial goals before budgeting for business. Han says, “As a CMO, setting clear financial goals is paramount. It allows us to align our marketing tactics with our budget objectives. This guarantees that we allocate resources wisely to maximize ROI ultimately.”

2. Choose your Budget Template

After setting financial goals, it’s time to select a budget template for your business. All you need to do is navigate to Google Sheets and explore the Template Gallery to find a suitable template. With a wide array of selections available, you can pick one that best fits your business needs and requirements.

To get started, follow the steps below:

☑ Open Google Sheets.

☑ Click on “Template gallery” at the top right corner.

☑ Browse the available templates.

☑ Choose a budget template best suited to your needs.

Grant Aldrich, founder of Online Degree, recommends being critical when choosing a budget template for a business. Aldrich argues, “Take it from us: Selecting the right budget template is crucial to effective financial management. Google Sheets offers a range of options in its Template Gallery, providing businesses like ours with the tools needed to streamline budgeting and drive financial success.”

3. Customize your Template

As cited, Google Sheets allows you to customize your budget template. You can tailor the template you select to match your financial needs and business preferences.

Start by customizing the categories, labels, and formulas as needed. This guarantees the template aligns perfectly with your organizational structure and budgeting requirements. Here’s how:

☑ Rename categories: Modify the income and expense categories to match your business activities.

☑ Add/delete rows and columns: Adjust the template’s structure to include all relevant financial items.

☑ Insert Your Data: Input your company’s financial data, such as monthly income, expenses, and other relevant figures.

Here’s the good news: Most templates will have built-in formulas for basic calculations. Ensure these formulas are correctly applied. For instance:

☑ Totals: Verify that sum formulas accurately total your income and expenses.

☑ Net Income: Ensure the template calculates the net income (total income minus total expenses).

☑ Percentages and Ratios: Check if there are any formulas calculating vital financial ratios and percentages, like profit margins.

Thomas Medlin, Co-founder at JumpMD, highlights the value of Google Sheets budget templates for business. Medlin explains, “We have our fair share of leveraging Google Sheets for financial management in our company. However, customizing our budget template is crucial for ensuring it reflects our unique financial landscape. By personalizing categories and formulas, we can streamline our budgeting process.”

4. Start Tracking Finances

At this point, it’s time to start recording all financial transactions and tracking all economic activities. Begin recording your financial data in the budget template and calculate complex financial metrics in a finance calculator. However, input income, expenses, and other financial details regularly to monitor your financial performance and make informed decisions.

☑ Income: Enter all sources of revenue your business receives. This could include sales, service fees, interest income, etc.

☑ Expenses: Record all outgoing funds. Common categories include salaries, rent, utilities, marketing, supplies, etc.

Mark Pierce, CEO of Wyoming Trust, emphasizes that financial monitoring is the most critical part of budgeting. Pierce cites, “As CEO, tracking finances diligently is essential for driving our company’s success. By recording our financial data promptly and accurately, we gain valuable insights regarding our business finances. That enables us to make strategic decisions and achieve our business goals.”

5. Monitor your Cash Flow

Of course, you must keep a close eye on your company’s cash flow by regularly reviewing income, expenses, and liquidity. Monitoring cash flow helps you understand how money moves in and out of your business. Doing so enables you to make educated financial decisions and establish financial stability.

Here’s what to consider:

☑ Cash flow statement: Some templates might include or allow you to create this statement. They help monitor the inflow and outflow of cash to ensure you have enough liquidity.

☑ Budget projections: Use historical data to project future income and expenses. This step helps in planning and making informed business decisions.

Jonathan Feniak, General Counsel at LLC Attorney, believes that cash flow is the core of business budgeting. Feniak emphasizes, “Monitoring cash flow is essential for safeguarding our business’s financial health. By staying vigilant and reviewing income and expenses regularly, we ensure sufficient liquidity to meet our obligations and seize growth opportunities. Ultimately, we want to ensure we earn more than we spend on our business.”

Nimble PPM for Advanced Budget Management

While Google Sheets budget templates offer a solid foundation for financial planning, businesses seeking more comprehensive budget management solutions may want to consider Nimble PPM (Portfolio Project Management). This powerful tool goes beyond basic spreadsheet functionality to provide robust features tailored for enterprise-level budget allocation and management.

Key Features of Nimble PPM for Budget Management:

☑ Centralized Portfolio Management: Nimble PPM allows enterprises to consolidate program and project requests from various departments, facilitating a structured review process for funding decisions.

☑ Strategic and Execution Portfolio Management: The tool supports both strategic planning (idea collation, evaluation, and approval) and execution management of approved programs and projects.

☑ Demand Capture and Evaluation: Easily capture and review ideas, initiatives, or projects individually or as part of a larger portfolio, aligning them with organizational goals.

☑ Budget Allocation and Monitoring: Approve shortlisted demands, allocate budgets, and track actual execution against approved budgets.

☑ Periodic Review and Reallocation: Conduct regular reviews of programs and portfolios, with the flexibility to reallocate budgets as needed.

☑ Versatile Project Support: Suitable for various project execution methodologies, including Agile and Waterfall.

☑ ROI Monitoring: Track the return on investment for approved projects, informing future funding decisions.

By offering these advanced features, Nimble PPM provides a more sophisticated alternative to spreadsheet-based budgeting. It’s particularly beneficial for larger organizations or those managing complex portfolios of projects and programs.

While Google Sheets remains an excellent option for smaller businesses or those just starting with formal budgeting processes, Nimble PPM offers a scalable solution that can grow with your organization’s financial management needs. It bridges the gap between simple spreadsheet tracking and enterprise-level portfolio management, providing a comprehensive tool for strategic financial planning and execution.

As your business evolves, consider exploring Nimble PPM to take your budget management capabilities to the next level, ensuring that your financial strategies align closely with your overall business objectives. Request for a demo of Nimble PPM here.